What You Need To Know About Non-Fungible Tokens (NFTs)

If you’ve been on the internet in the past several months, you’ve probably heard the acronym “NFT.” Or maybe you’ve seen some drawings of monkeys wearing clothes, or heard the term “CryptoKitties.” So what are these?

They are part of a relatively new collectable market coming out of blockchains. NFT stands for non-fungible token, which is a unique item that is “minted” on a blockchain. In comparison, a “fungible” token is something that is not unique, such as a bitcoin. When something is “minted” on a blockchain, its data has been validated, put into a block, and recorded on a blockchain.

An NFT is a commodity that guarantees scarcity and proof of ownership. NFTs could potentially be anything digital, such as a video, a GIF, or music. Remember the “Charlie Bit Me” viral YouTube video? That deleted video was recently sold as an NFT for $760k. You can also buy an NFT of a song from your favorite band.

However, the digital art world is what seems to be exploding right now. Take this Beeple artwork that sold for $69.3 million at Christie’s auction house, for instance. The artwork, “Everydays: The First 5000 Days,” is a collage of art pieces that the artist worked on every day for over 13 years.

Christie’s is traditionally known for selling paintings by artists like Van Gogh and Picasso, but it started selling digital artwork in 2018. Before NFTs, it was pretty hard for creators of digital art to make a living off of their work because it could be copied and pasted around the internet. But NFTs are beginning to transform how internet artwork is valued.

NFT platforms can write provisions into their code to ensure that the artist will get a percentage of each transaction on that NFT. Beeple received approximately $56 million as his share of the Christie’s sale. There is still nothing preventing people from copying and pasting digital artwork, but the value of an NFT is that someone “owns” it on the blockchain. Think of Van Gogh’s “Starry Night” — someone has the original painting hanging on their wall, but you could easily look at a picture of it, own a print of it, or even have some Starry Night socks.

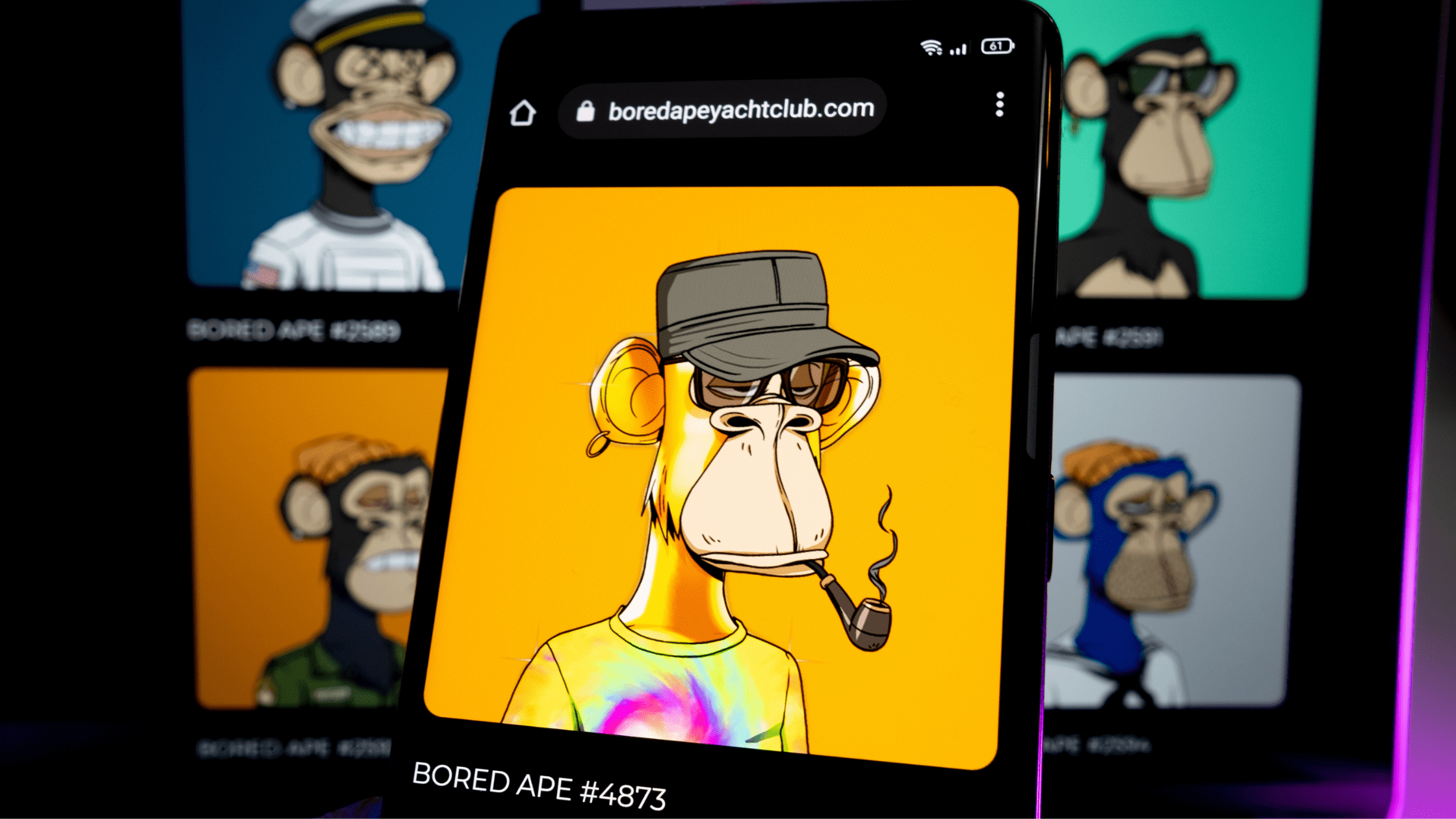

Other NFTs are meant to be more like trading cards. One example is the Bored Ape Yacht Club, where collectors can buy an image of an ape wearing a specific outfit. The Bored Ape Yacht Club is a collection of 10,000 minted ape NFTs, and owning one of them grants entry to members-only portions of the website. The original drop of the minted apes has sold out, but the secondary market for these NFTs is very active. OpenSea, a platform for the reselling of NFTs, has more than a thousand of these apes for sale/auction with ETH (the Ethereum blockchain coin). As of the writing of this blog, the highest sale on OpenSea for one of these apes is 769 ETH, or about $25 million USD.

These prices may seem crazy, but considering the created scarcity of NFTs, how is it any different than spending $493,000 for a Pokemon card? For some reason, collectible items make people do some crazy things and spend a lot of money.

Several NFT platforms are gamifying NFTs. One of the most well known is CryptoKitties, which allows you to purchase an NFT of an adorable kitty and “breed” it to mint a new one. You can also participate in games with your cat in the KittyVerse.

Not all NFTs are crazy expensive, though. You can purchase a CryptoKitty for 0.005 ETH (about $16 USD). There are also NFT platforms that remind me of Farmville, like Wanaka Farm, where you can purchase NFTs for seeds, crops, and livestock in your farm.

There are problems with NFTs of course, and that’s part of the reason why they’ve gotten so much attention:

- They’re built on top of blockchains, which can be controversial. Some blockchains, like Bitcoin, are “proof-of-work”, which means they are energy-intensive and therefore bad for the environment. Not all blockchains are this way, such as NEAR, which is pledged as carbon neutral.

- Since NFTs are digital pieces of information, their file formats could become outdated, or the URL where the image is hosted just could go away.

- When an ordinary stock is sold, the seller owes up to 15% in capital gain tax. However, “collectibles” are taxed at a maximum of 28% capital gain. The IRS has not yet stated if profits from NFTs will be taxed as “collectibles,” so NFT traders could potentially owe a lot in taxes.

- There is a lot of trust going into the platform you buy the NFT from. Is the platform actually marking you as the owner? Is your token really being saved on a blockchain?

- Some NFT marketplaces can load custom code when anyone simply views an NFT listing. This can be used for XSS (cross-site scripting) attacks and can gather information about the people viewing the NFT, like their IP addresses.

- Many people are purchasing them without actually understanding what they are, which is never a good idea for an investment.

I’ve owned many collectibles: Beanie Babies, Funko Pops, Pokemon cards, etc. Yes, these are all physical objects, but I also loved Neopets when I was younger, and I value supporting artists. So would I ever purchase an NFT? I haven’t decided yet, but I think the creativity associated with NFTs is fascinating. As with any investment, you should do your research and proceed with caution as the crypto world is highly volatile.

As Mark Cuban once said: “Nobody ever changed the world by doing what everyone else was doing.” By the way, you can buy that quote as an NFT.