Creating Successful Online Banking Products – Agile Growth Workshop Recap

Banking and financial institutions are rapidly working on digitizing products to stay relevant and better serve customers, but, the truth is, modernizing banking experiences is incredibly difficult. A digital project in the banking world is nothing short of an order of magnitude. The requirements behind developing successful banking products are staggering compared to the average consumer product, but the high ROI of launching a successful banking app makes it all worth the effort.

Carbon Five hosted a panel discussion on Expert Insights for Creating Successful Online Banking Products. During the conversation, panelists shared first-hand experiences working with some of the most well-known banking and FinTech brands, including Capital One, Citi Ventures Studios, Chime, Commerce Bank, FNBO, Plastiq, Square, Wells Fargo and more.

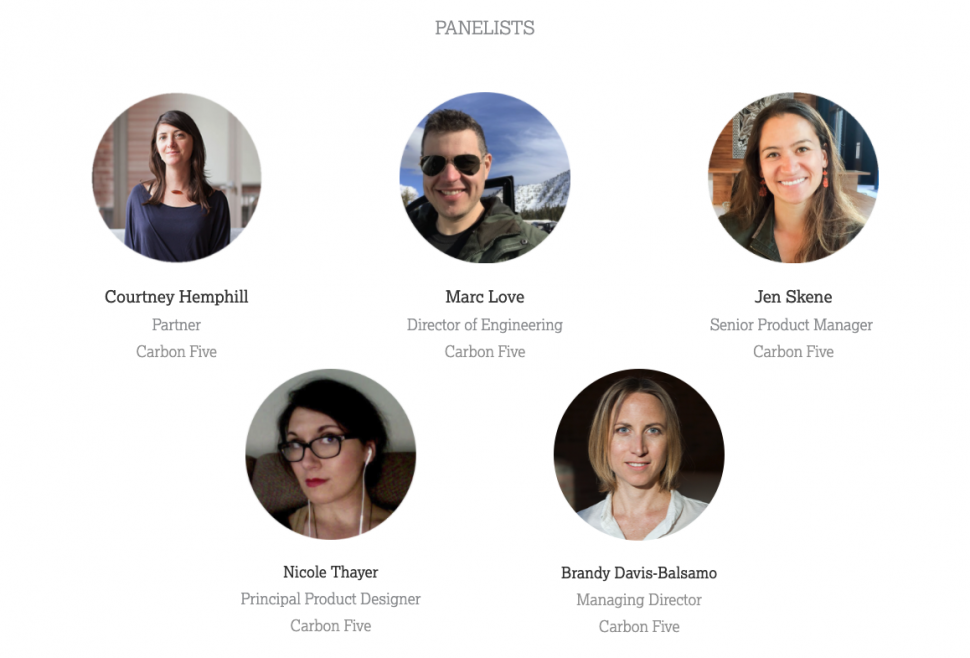

Banking product development panelists:

- Courtney Hemphill, Partner and VP of Product, Carbon Five

- Marc Love, Director of Engineering, Carbon Five

- Jen Skene, Senior Product Manager, Carbon Five

- Nicole Thayer, Principal Product Designer, Carbon Five

- Brandy Davis-Balsamo, Managing Director, Carbon Five (moderator)

Access the complete workshop recording here:

A few highlights from the discussion…

Legacy infrastructure and industry regulations are the most common challenges to navigate when building digital banking products.

“Modernizing the bank is oftentimes relatively difficult because the infrastructure has been put into place for many years, so the ability to act on customer needs is not as quick as modern competitors or new startups.” – Courtney Hemphill

Embracing a startup mindset can help increase velocity, accelerate time to delivery, improve quality, and promote team retention during product development.

“Working in a regulated industry, the requirements are really complex and it takes a while to discover what those requirements are, but we don’t have to wait until we know what everything is going to do before we start building…the development can be iterative and just as scrappy as a startup [even] though you’re not going to release quite as frequently.” – Jen Skene

“There are constraints that you just have to deal with within the banking industry, but there are [also] underlying reasons for the constraints. So as problem solvers, it’s interesting to engage your team on how you might rethink the underlying issue that causes the constraint to move in a more efficient manner.” – Marc Love

Monitoring internal team morale is especially important since banking apps generally are not released until full completion.

“One way to address that is to do beta releases within the larger organization so coworkers can see the things [you’re] building, which creates excitement within the company and can improve morale.” – Marc Love

“Another way to keep morale up and keep what you’ve accomplished front of mind is to talk to users and get user feedback. I’ve seen a huge boost in team morale when… you’re able to bring feedback from users that say ‘This is a change for the better. We’re really happy with it. We’re really excited to see it launched,’…That kind of positive feedback and listening to your target audience’s desire for change is also very powerful.” – Nicole Thayer

Successful banking apps focus on consumer experiences, not just slick design.

“Customers are not just about banking, they’re about an experience…customers want to be seen by banks even if all they’re just doing is financial transactions. They want to still feel like a customer and want to still feel like they’re being addressed based on their life needs…thinking of the customer from a holistic standpoint is quite valuable.” – Courtney Hemphill

“[Banks have] this huge customer base with certain expectations, so on some level, the best design, the sweet spot, is something that people who have used this product for years are comfortable with and something that looks and feels modern for new users. Bridging that gap doesn’t mean you’re going to be coming up with all new patterns. You’re going to be adapting old patterns to meet user expectations and bring new users in.” – Nicole Thayer

Product development challenges in banking can make applying lean and agile methodologies daunting, but navigating the complexities of the industry with the right tools, team, and approach can relieve that pressure to help banking and financial institutions swiftly achieve their digital goals.

Watch the complete workshop recording to get more actionable tips on building highly rated banking apps. Reach out with any questions or schedule a free consultation with one of our product development experts.